Jakarta, October 18, 2025 – The participation of the Jakarta Futures Exchange (JFX) and the Indonesian Derivatives Clearing House (KBI), part of the state-owned holding company Danareksa, in Minerba Convex 2025 represents a significant milestone in strengthening the governance and competitiveness of national commodity trade.

With over 700 booth visitors and talk show participants in attendance, the enthusiasm of the public and stakeholders demonstrates the high level of interest in JFX and KBI's efforts to realize transparent, credible, and globally recognized tin trade.

At this exhibition, JFX showcased its latest achievements and innovations in tin trading, while also introducing development directions for other strategic commodities, from minerals and coal to energy, agriculture, and precious metals. This step is part of the strategy to diversify products and strengthen the value chain of the Indonesian mineral and coal industry.

This participation aligns with the national Minerba One program initiated by the Ministry of Energy and Mineral Resources. Minerba One, through MODI (Minerba One Data Indonesia) and MOMI (Minerba One Map Indonesia), aims to strengthen traceability, transparency, and industry oversight, while supporting state revenue. All members of the JFX-KBI Tin Exchange have reported their transactions to MODI, aligning this step with the government's efforts to build integrated mining governance.

"JFX and KBI's participation in Minerba Convex 2025 is a response to market challenges, ranging from price fluctuations, the need for transparency, to increased global competitiveness. Our Tin Exchange has proven that transactions are transparent, credible, sustainably monitored, and offer competitive prices. Our commitment is to provide added value to the industry, support downstreaming, and expand our reach to other mining commodity trades," said Yazid Kanca Surya, President Director of JFX.

Since 2019, JFX and KBI have recorded a tin trading volume of over 300,000 tons with a value of US$8 billion, involving more than 60 active business players. In 2024, more than 95% of national tin transactions, both domestic and export, were recorded through JFX and KBI, confirming their position as key pillars in the global supply chain.

"KBI plays a role in maintaining financial integrity in clearing services and guaranteeing transaction settlements across the futures trading ecosystem. Together with JFX, we continue to improve innovation in clearing and guarantee services in the mineral and coal sector, adopting information systems and technology, and digital services that are reliable, transparent, and trustworthy," explained Budi Susanto, President Director of KBI.

In the Minerba Convex 2025 talk show, Bappebti, as the futures trading supervisory authority, emphasized that tin trading through JFX contributes to strengthening export governance, reducing illegal practices, and increasing state revenue.

"JFX and KBI's steps to strengthen mineral and coal trade governance demonstrate their contribution to transforming the market toward global competitiveness. Bappebti fully supports this effort as part of Indonesia's increasingly integrated strategic commodity ecosystem,"

said Ima Siti Fatimah, Head of the Commodity Futures Trading Development and Development Bureau.

Bappebti also emphasized the importance of encouraging business actors to conduct hedging activities domestically. This effort can be strengthened through the involvement of liquidity providers, one example being JFX's collaboration with Onyx Capital Group, to increase market liquidity and national trade competitiveness.

In addition to appearing at the booth and in the talk show, the JFX President Director also spoke in a breakout room entitled "Mining's Contribution to National and Regional Development." In the session, he emphasized the importance of downstreaming and the presence of exchanges in producing countries, so that the added value of commodities such as tin, nickel, and CPO remains domestic.

"We at the Exchange are committed to launching relevant futures products, ensuring that downstream processing takes place in Indonesia. This way, added value and a longer business chain can be extended domestically, strengthening the industry's contribution to the national economy," said Yazid Kanca Surya.

The participation of JFX and KBI in Minerba Convex 2025 demonstrates multi-stakeholder synergy in addressing industry challenges and building an adaptive, credible commodity trading ecosystem that supports a sustainable energy transition.

PT Kliring Berjangka Indonesia (PT KBI) is establishing itself as part of the country's economic growth agent

PT Kliring Berjangka Indonesia (PT KBI) has started a new step in implementing the CSR program

PT Kliring Berjangka Indonesia (PT KBI) has held an inauguration for their new office at Menara Danareksa

Asset Auction

Asset Auction

Langkah Strategis PT KBI dan Bank BJB untuk perkuat Sistem Resi Gudang Indonesia

KBI Achieve the "Best Corporate in Establishing The AKHLAK Implementation Index" Award at the 2024 BUMN Awards

KBI Ramadan Media Gathering Moving into Action for Better

KBI participated in organizing Mudik Asyik Bersama BUMN in 2024

PT KBI and JFX held a Halal Bihalal event with futures trading industry

Universitas Airlangga FTLC Program with PT Valbury, JFX and KBI

KBI Cooperates with BRI (BBRI) as Margin Fund Depository Bank

PT Kliring Berjangka Indonesia Achieves idAA Stable Outlook Rating On Operational Performance in 2023

PT KBI Wins Gold Award in Economic Pillar Category at TJSL & CSR Award 2024

PT KBI wins the 5th Anniversary Indonesia Popular Reputation Awards 2024

Supporting the government's Food Security program, PT KBI and PT JIEP developed a Warehouse Receipt System.

PT KBI supports PBK Literacy Month, focusing on digital transformation and strengthening synergy in the commodity future

PT KBI and PT KIMA collaborate to develop industrial area warehouse as a strategic step to strengthen the company

PT KBI strengthens Indonesia's food security by developing a Commodity Trading Ecosystem through synergy and system tran

Collaboration between PT KBI, PT KPBI, and Bank Jatim Develops Warehouse Receipt

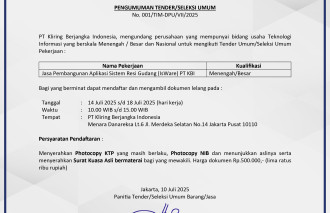

PT Kliring Berjangka Indonesia Mengadakan Tender Umum

PT KBI Holds KBI 5th ESport Championship Again

KBI's Role in Futures Trading Ecosystem

PT KBI Collaborates with Bank INA as BPDM

PT KBI Partners with Bank BJB to Strengthen Commodity Trading Ecosystem

PT KBI is Optimist to Strengthen Physical Digital Gold Trading in 2025

PT KBI Strengthens National Food Security Program Through Optimization of Rice Barns in Jombang, East Java

PT KBI wins prestigious award for Best Public Relations in the Financial Services category

PT KBI once again received a prestigious award in digital innovation at the 6th Indonesia Top Digital Innovation Award

In the spirit of the holy month of Ramadan, PT KBI encourages spreading kindness through Ramadan Bergerak campaign

KBI recorded a surge in strategic commodity transaction volumes amid geopolitical and economic uncertainty.

Global economic uncertainty caused by geopolitical tensions and trade wars has led to a shift in investment to gold, whi

It is not just about cultivating commodities, but this issue has deep links to issues of sustainability

Pengumuman Tender Umum/Seleksi Umum Untuk Perusahaan IT

A country with vast agribusiness and logistics potential, Indonesia requires a transparent & reliable warehouse system

Bank Muamalat collaborates with KBI in the use of banking services for transaction settlement

PT KBI as the only Warehouse Receipt Registration Center in Indonesia

PT KBI Received the 50 Popular PR Person Award of 2025 at The Iconomics event

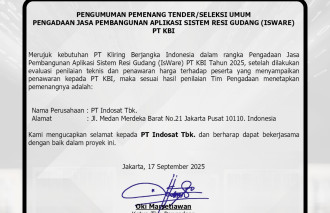

Pengumuman pemenang tender umum pengadaan jasa pembangunan aplikasi sistem resi gudang (ISWARE) PT KBI

The Golden Generation with CFTC Skills: Understand Risks and Opportunities

Scholarship program for undergraduate students

Realizing Industrial Estate Warehouse Integration and Warehouse Receipt

Warehouse Receipt Ecosystem Synergy at Trade Expo Indonesia 2025

JFX and KBI Synergy in Commodity Trading Mining

PT KBI Promotes Auction of 20 Tons of Coffee Runs Successfully

KBI Expands Role until US Stock Exchanges